- VERIFICATION OF 2016 TAX EXTENSION PDF

- VERIFICATION OF 2016 TAX EXTENSION VERIFICATION

- VERIFICATION OF 2016 TAX EXTENSION PROFESSIONAL

VERIFICATION OF 2016 TAX EXTENSION VERIFICATION

All verification documentation delays due to a tax-filing extension must be turned in to our office by November 1 to avoid a return of any federal aid disbursed to the student’s account. We will also need copies of all W2s for each source received in 2020. If you file an extension for 2020, you will need to send our office a copy of IRS form 4868 or a copy of the IRS approval for an extension that goes beyond the automatic 6 months extension.

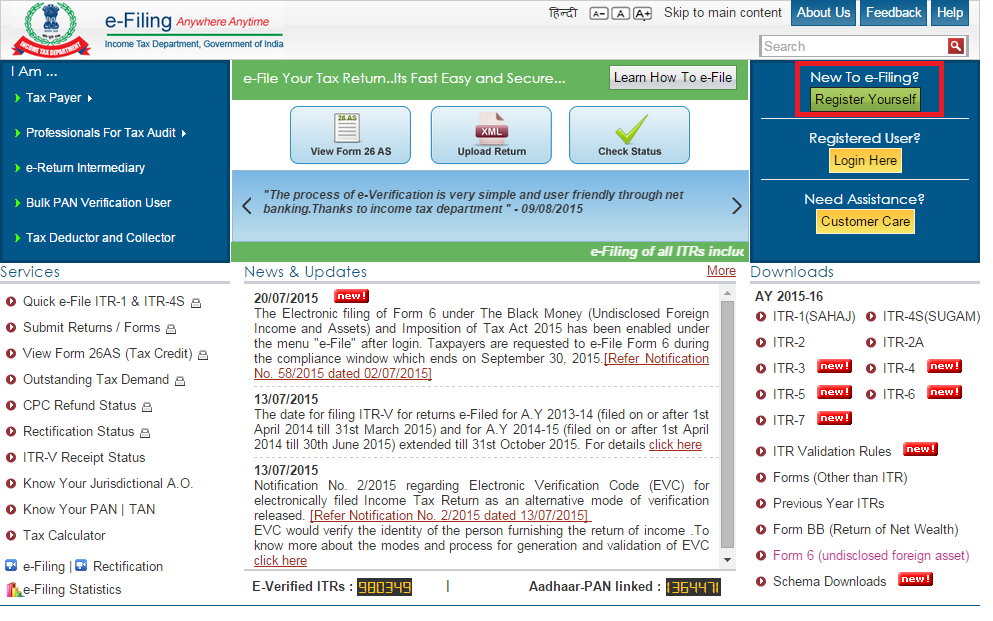

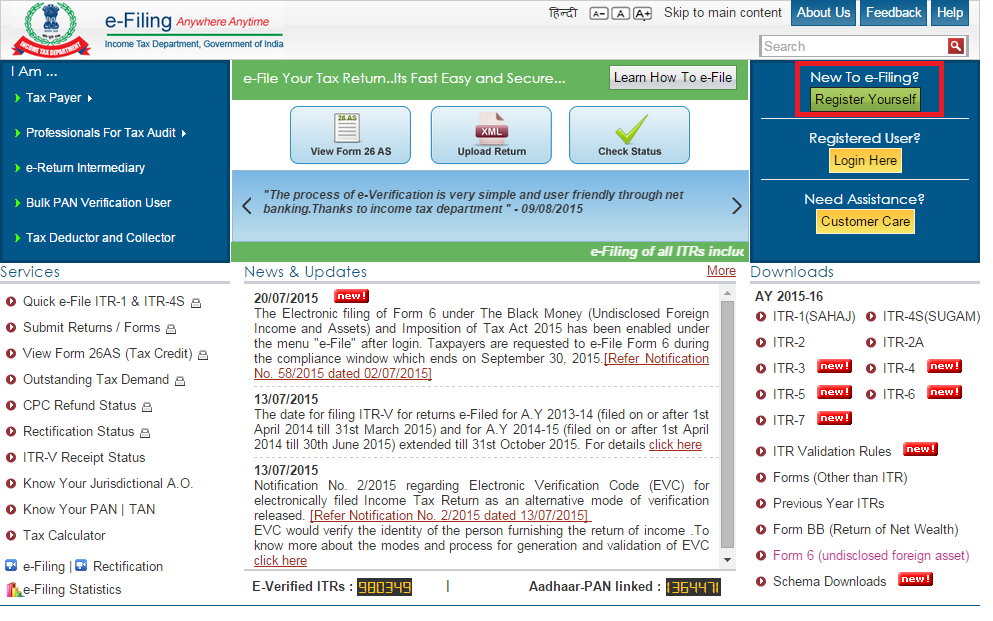

Receive tax transcript within 5 to 10 working days. extension of time to file your individual income tax. Mail or fax the completed form to the appropriate address. You will be asked to provide the Adjusted Gross Income from the return for taxpayer verification. Receive your tax transcript within 5 to 10 working days. VERIFICATION OF 2016 TAX EXTENSION PDF

Click “Order a Tax Return or Account Transcript” or set up a login and download a pdf version of the tax return transcript (login method recommended). You may request a 2020 tax return transcript from the IRS, free of charge, in one of four ways: If your marital status changed from married to single, you need to contact our office. NOTE: If your marital status changed after January 1, 2020, you must send IRS tax return transcript(s) and all W-2s that reflect your current status to our office. Our office will mail and/or email any missing documents required. You may be required to send in signed statements regarding your household size, child support documentation, food stamp documentation, high school completion status, Identity/Statement of Educational Purpose, a Confirmation of Number in College Form, W2s, etc. In addition to the IRS tax return transcripts, our office may request other documentation to complete verification. These are no longer acceptable verification documents. If you did not or were not able to use the IRS Data Retrieval Match Process, please submit your 2020 Student/Spouse, if married, IRS tax return transcripts(s) and the 2020 Parent(s), if dependent, IRS tax return transcript(s) upon request. If you mailed your tax return, your information should be available on the IRS website within eight weeks. If you filed electronically, your information should be available on the IRS website within two weeks of the filing date. For example, if your parents are married and filed separate returns they will each need to request an IRS tax return transcript (not the tax ‘account’ transcript) and send them to our office. Some applicants are not eligible for this process.

To avoid verification delays, use the IRS Data Retrieval process when filing your FAFSA. See the complete Federal Verification Policy Verification Instructions Oscar & Anna Laura Page Meditation Garden.Support Services for International Students.Center for Southwestern & Mexican Studies.Center for Community & Regional Development.

VERIFICATION OF 2016 TAX EXTENSION PROFESSIONAL

Center for Career & Professional Development.Teaching/Course Certification Requirements.

Institutional Marketing & Communications.

0 kommentar(er)

0 kommentar(er)